how to put instacart on taxes

First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. By the end of 2020 this market share had doubled to 22.

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

For Instacart to send you a 1099 you need to earn at least 600 in a calendar year.

. Learn the basic of filing your taxes as an independent contractor. Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. Fill out the paperwork.

With TurboTax Live youll be able to get unlimited advice. Accurate time-based compensation for Instacart drivers is difficult to anticipate. Your 1099 tax form will be mailed to you if you dont receive an email from Stripe or dont consent to e.

Your 1099 tax form will be available to download via Stripe Express. Make sure to keep these two rules in mind. For 2020 the mileage reimbursement amount is 057.

Put 20 away for the just in. Part-time employees sign an offer letter and W-4 tax form. When deducting your health insurance youll fill out Line 29 on Form 1040.

Depending on your state youll likely owe 20-25 on your earnings from instacart. June 5 2019 247 PM. 20 minimum of your gross business income.

You expect your withholding and credits to be. This means for every mile you drive you pay 057 less in. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

Pay Instacart Quarterly Taxes. If you have a W-2 job or another gig you combine your income. There will be a clear indication.

Independent contractors have to sign a contractor agreement and W-9 tax form. Most states but not all require residents to pay state income tax. I just put in the 1099 form once a year but I literally write off all my miles insurance internet car bill etc.

Reports how much money Instacart paid you throughout the year. Youll include the taxes on your Form 1040 due on April 15th. As an Instacart Shopper youll likely want to be familiar with these forms.

Then if your state. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. As an independent contractor you must pay taxes on your Instacart earnings.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly. What percentage of my income should I set aside for taxes if Im a driver for Instacart. The tax rates can vary by state and income level.

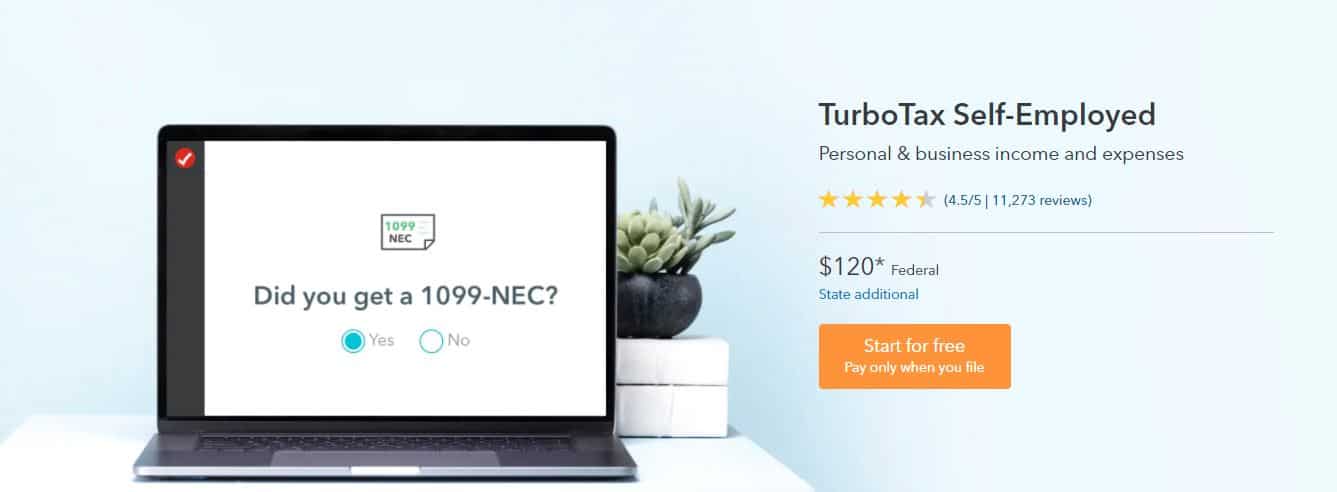

Up to 5 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year. Tax tips for Instacart Shoppers.

If you receive a government subsidy on your monthly. First fill out Schedule C with the amount you made as indicated in Box 7 on your. Even if you made less than 600 with Instacart you must report and pay taxes on your income.

Instacart delivery starts at 399 for same-day orders 35 or more. Start Instacart Tax Return Instacart Shoppers Qualify for a Forgivable loan. And if you make money outside of Instacart your tax.

Be sure to file separate Schedule C forms for each separate freelance work that you do ie. The organization distributes no official information on temporary worker pay however they do. Irs free file site gives you access to the self employed version.

I end up getting a refund. Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities.

First make sure you are keeping track of your mileage. According to eMarketer Instacart was responsible for just under 11 of e-commerce grocery sales in 2019.

What You Need To Know About Instacart Taxes Net Pay Advance

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

How Much Of My Earnings Doordash Grubhub Uber Eats Etc Is Taxable

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart 1099 Taxes

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Q A 2020 Taxes Tips And More Youtube

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Handle Your Instacart 1099 Taxes Like A Pro

How To Get Instacart Tax 1099 Forms Youtube

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Taxes The Complete Guide For Shoppers Ridester Com